“Powering the Future: Rapid Growth of Lithium Iron Phosphate Batteries in the Energy Storage Industry”

Introduction:

The first half of 2023 witnessed a remarkable 29.7% year-on-year increase in the value added to China’s large-scale lithium-ion battery manufacturing industry. The export of the “New Trio” products, including lithium batteries, solar batteries, and electric passenger vehicles, surged by an impressive 61.6%. Among these products, energy storage emerged as a new and robust growth driver for lithium battery applications. Notably, the booming development of energy storage has propelled the rapid expansion of the lithium iron phosphate battery segment. Industry insiders predict that the energy storage sector will continue its significant growth trajectory, with an exceptionally promising outlook over the next 3 to 5 years.

The Growth Catalyst:

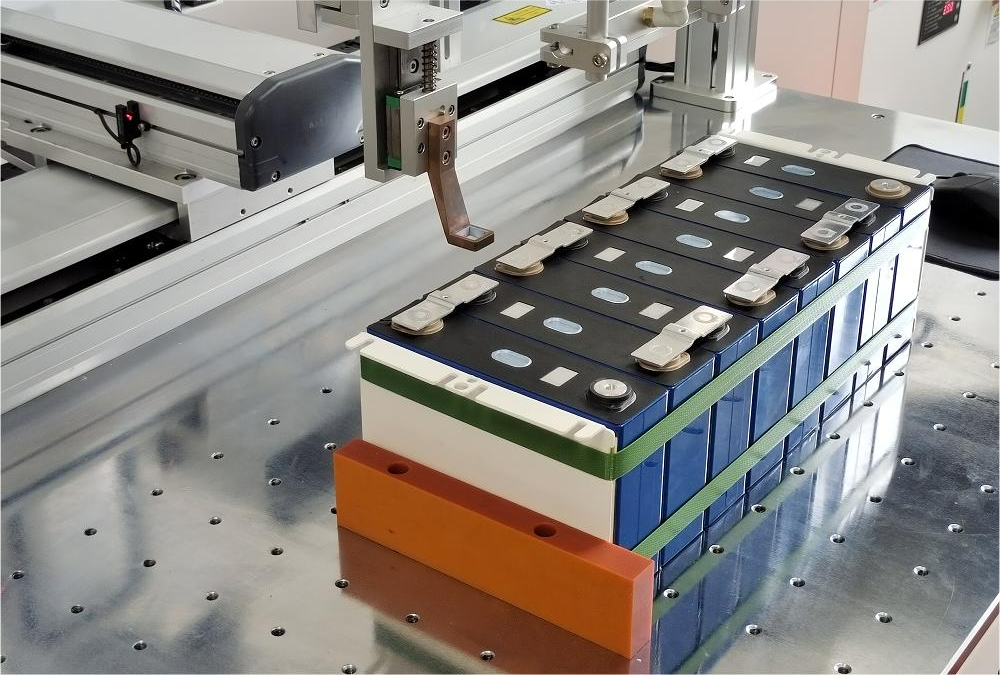

Energy Storage Accelerates the Rapid Development of Lithium Iron Phosphate Batteries: Industry growth in the first half of the year can be largely attributed to the soaring demand for lithium iron phosphate batteries, driven by the upsurge in electrochemical energy storage projects. As safety concerns led to the prohibition of ternary materials, and new alternatives like sodium-ion batteries remain in small-scale demonstration applications, lithium iron phosphate batteries have dominantly captured the energy storage market. According to statistics from the Energy Storage Branch of the China Battery Industry Association, a staggering 76% of energy storage projects in the second quarter of 2023 opted for lithium iron phosphate battery storage solutions.

Future Prospects:

Sustained Growth of the Energy Storage Industry: Several factors contribute to the positive outlook for the energy storage industry, ensuring its continued rapid growth:

- Top-Level Policy Guidance: Guided by top-level policies, the energy storage sector is embarking on a new stage of large-scale development.

- Growing Renewable Energy Installations: The mandatory integration of energy storage with renewable energy installations (such as wind and solar) brings stable market growth.

- Stabilizing Lithium Iron Phosphate Material Prices: The stabilization of lithium iron phosphate material prices, coupled with the expansion of battery manufacturers, lowers cell costs, resulting in significant reductions in energy storage system expenses and boosting customer interest in installations.

- Reforms in the Power Market: Power market reforms facilitate smoother business models for user-side energy storage and incremental distribution networks, making energy storage profitability more apparent. With peak and off-peak price differentials offering significant benefits, large-scale industrial and commercial users exhibit a stronger willingness to adopt energy storage, and high-tech enterprises find it favorable as the backup power source.

- Burgeoning European Demand for Home and Commercial Energy Storage: In Europe, the demand for home energy storage is thriving, and commercial energy storage is also gaining momentum. As the share of renewable energy increases, the energy storage market is poised to sustain a positive growth trajectory.

Conclusion:

The first half of 2023 marked significant progress in the lithium battery industry, largely driven by the surging demand for lithium iron phosphate batteries in the energy storage segment. With favorable policies, increasing renewable energy installations, stabilizing material prices, and power market reforms, the energy storage industry is expected to maintain its robust growth in the coming years, fostering a sustainable and innovative energy landscape.