In recent years, the market demand for lithium batteries has been strong, and the overall shipments of lithium battery cathode materials have grown rapidly and there is broad room for market growth. According to an agency report, the shipment of lithium battery cathode materials in 2016 was 161,000 tons, and it will increase to 1.094 million tons by 2021, with an average annual compound growth rate of 46.70%. In 2021, the shipment of cathode materials will increase by 98.5% year-on-year. It is estimated that the demand for cathode materials will reach 2.25 million tons in 2025. Among them, the demand for lithium iron phosphate materials is 1.39 million tons. From 2021 to 2025, the compound annual growth rate of demand for lithium battery cathode materials will be 41.58%, of which the average annual compound growth rate of lithium iron phosphate will reach 55.13% respectively.

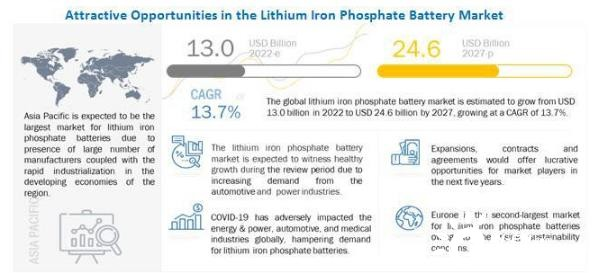

Under the goal of carbon peak and carbon neutrality, the demand for energy storage batteries in many application scenarios will gradually increase. As the world’s largest producer and manufacturer of lithium batteries, China will gain greater opportunities for development. According to a report released by the international market research organization Markets and Markets, the global lithium iron phosphate battery market is expected to grow from US$13 billion in 2022 to US$24.6 billion in 2027, with a compound annual growth rate of 13.7%.

The major driver of the lithium iron phosphate battery market is the growing demand for lithium iron phosphate batteries from the automotive industry, especially for electric vehicle applications.

As industrial automation advances, so does material handling equipment to support the changing needs of various industries, including warehouses, logistics, food and beverage, and healthcare for fast and efficient battery-powered equipment such as AGVs and electric forklifts demand is also increasing.

R&D initiatives by battery manufacturers to develop lithium iron phosphate batteries and increase their battery production capacity have increased significantly. For example, among the world’s leading LFP manufacturers, CATL is equipped with about 200GWh of battery capacity in 2021 and plans to increase its capacity to about 500GWh by 2025. Due to the increasing application of lithium iron phosphate batteries, market players are also witnessing expansion and investment in facility development to accommodate potential demand growth.

Lithium iron phosphate batteries have a lower energy density compared to other lithium-ion batteries. In the current context, a key consideration is that batteries used in electric vehicles should be small and lightweight. The automotive segment is expected to be the fastest-growing segment in the lithium iron phosphate battery market during the forecast period. The global market is segmented by industry into automotive, power, industrial, aerospace, marine, and others. The high growth rate in the automotive segment can be attributed to the growing demand for electric vehicles owing to the transition to the adoption of clean energy in various economies around the world.

The Asia-Pacific region will be the largest regional market for the lithium iron phosphate battery market, followed by Europe. Asia Pacific is also expected to be the fastest growing market during the forecast period. The growth of the lithium iron phosphate battery market in the Asia Pacific is mainly driven by the development of the automotive and power industries in economies such as China, Japan, India, and South Korea.