Lithium-ion batteries are nearing their energy density limits and face thermal runaway risks. With higher safety and energy density requirements, solid-state batteries have emerged. Solid-state batteries use solid electrolytes for lithium-ion conduction, with a different ion transport mechanism than liquid electrolytes. By introducing non-flammable solid electrolytes, safety is fundamentally ensured while also accommodating high-energy-density electrodes. Solid-state batteries are poised to be the ultimate solution for next-generation power cells, with companies globally entering a competitive phase of R&D for solid-state batteries. Once commercialized, they are expected to bring about disruptive changes in the industry. We will primarily cover the concepts, advantages, and industry status of solid-state batteries, and predict their future development and penetration trends. We will also detail the industry chain and relevant companies, forecasting future market size. We hope this enlightens your understanding of the solid-state battery industry.

I. Industry Overview

- Concept

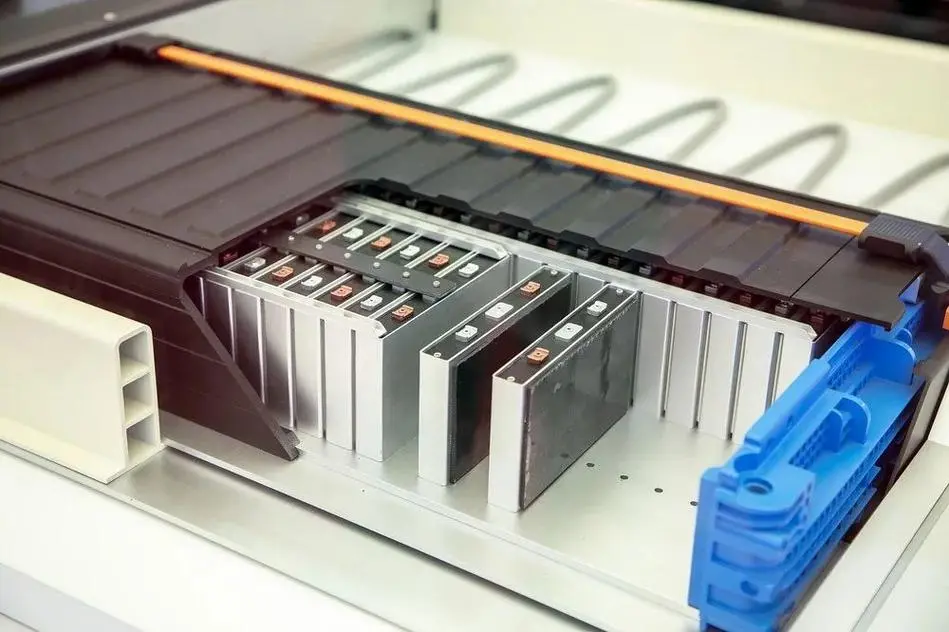

Solid-state batteries use solid electrolytes. Lithium batteries consist of positive and negative electrode materials, electrolytes, and separators, facilitating ion transport and current conduction. However, liquid electrolytes are flammable, corrosive, lack oxidation resistance, and cannot solve lithium dendrite issues, leading to thermal runaway risks and limiting the use of high-energy materials like high-voltage positive electrodes and lithium metal negative electrodes. Solid-state batteries replace part or all of the electrolyte with solid electrolytes, significantly enhancing safety and energy density, making it a long-term potential technology direction.

- Classification Based on electrolyte types, batteries can be classified into liquid (25wt%), semi-solid (5-10wt%), quasi-solid (0-5wt%), and all-solid (0wt%) states, with semi-solid, quasi-solid, and all-solid states collectively termed as solid-state batteries. Polymers, oxides, and sulfides are the three major classes of solid electrolytes for solid-state batteries.

Semi-solid-state batteries: Compared to liquid batteries, semi-solid-state batteries reduce electrolyte usage, and increase polymer + oxide composite electrolytes. Polymers form framework networks, oxides mainly coat electrodes, and negative electrodes transition from graphite to pre-lithiated silicon-based/n lithium metal ones, while positive electrodes shift from high nickel to high nickel-high voltage/rich lithium manganese-based ones. Separators retain and coat with solid electrolyte layers, and lithium salts upgrade from LiPF6 to LiTFSI, achieving energy densities of over 350Wh/kg+.

All-solid-state batteries: Compared to liquid batteries, all-solid-state batteries eliminate liquid electrolytes, using polymer/oxide/sulfide systems as solid electrolytes, separating positive and negative electrodes with thin films to replace separator functions, wherein polymers have lower performance limits, oxides are rapidly advancing, and sulfides show the greatest future potential. Negative electrodes upgrade from graphite to pre-lithiated silicon-based/n lithium metal ones, while positive electrodes transition to ultra-high nickel/nickel manganese oxide/rich lithium manganese-based ones, achieving energy densities exceeding 500Wh/kg+.

- Advantages and Disadvantages of Solid-State Batteries

Advantages: High safety: Non-flammable solid electrolytes significantly reduce thermal runaway risks. As energy densities of batteries increase, thermal runaway risks also rise. Batteries should ideally operate below 60°C, but due to factors like internal short circuits, external heating, and mechanical abuse, temperatures can rise to 90°C, causing the solid electrolyte interphase (SEI) film on negative electrodes to dissolve, exposing embedded lithium directly to the electrolyte, leading to rapid heat release and flammable gas generation, melting separators, forming internal short circuits, rapidly raising temperatures to 200°C, causing electrolyte gasification and decomposition, oxygen release from positive electrodes, leading to severe burning or explosions.

Solid-state batteries inherently possess safety, a major concern for manufacturers.

- Non-flammability, thermal stability: Liquid electrolytes are flammable and volatile, decomposing at around 200°C (separators at 160°C), posing safety hazards like corrosion and leakage. Solid electrolytes are non-flammable, non-corrosive, and non-volatile, with significantly higher decomposition temperatures, enabling operation at higher rates and temperatures. They are non-flowing, allowing batteries to withstand piercing, cutting, and bending, significantly reducing thermal runaway risks.

- Lithium dendrites: In liquid batteries, lithium dendrite growth easily pierces separators, causing short circuits. Solid electrolytes have high mechanical strength, slow lithium dendrite growth, and difficult penetration, enhancing battery safety.

- High energy density: Compatible with high-capacity positive and negative electrodes, significantly enhancing energy density. Solid electrolytes are compatible with high-capacity positive and negative electrodes, significantly boosting battery energy density. While solid electrolytes themselves do not increase energy density, their stability, and wide electrochemical window (over 5V), allow compatibility with high-capacity materials like high-voltage positive electrodes, rich lithium manganese-based, silicon negative electrodes, lithium metal negative electrodes, etc., thus dramatically increasing cell energy density. Material perspective: Solid electrolytes allow high-capacity positive and negative electrodes, substantially increasing cell energy density; Structural perspective: Solid electrolytes combine separator and electrolyte functions, reducing electrode spacing, lowering battery thickness, and increasing energy density; Pack perspective: Non-flowing solid electrolytes enable internal series connections, boosting pack energy density, reducing packaging costs, increasing volumetric energy density. Solid electrolyte safety reduces thermal management system requirements, significantly enhancing pack energy density.

Disadvantages of Solid-State Batteries

- Low ion conductivity, poor cycle life, hindering commercialization.

Low ion conductivity in materials: In solid-state batteries, the solid-liquid interface between electrodes and electrolytes changes to solid-solid, resulting in smaller contact areas and higher interfacial resistance due to lack of wettability, limiting lithium ion transport between positive and negative electrodes, affecting fast charging performance and cycle life. Poor cycle life: Solid-solid contact is rigid, and sensitive to electrode volume changes during cycles, causing particle-to-particle and particle-to-electrolyte contact deterioration, and stress accumulation, leading to electrochemical performance decay, cracks, rapid capacity degradation, and poor cycle life.

- High cost: Solid electrolytes contain rare metals, significantly higher than liquid batteries.

Solid-state battery costs are higher due to solid electrolytes and electrodes. Solid electrolytes are currently difficult to thin down, containing expensive raw materials like zirconium in oxide electrolytes and germanium in sulfide electrolytes. Additionally, active materials used for high-energy-density are not mature, with copper lithium composite belts priced at 10,000 RMB/kg. Full solid-state batteries demand more stringent production processes, higher equipment replacement rates, and significantly higher costs compared to current liquid batteries.

II. Industry Status and Trends

- Development Trends

Solid-state battery technology development and application are expected to show gradual penetration trends. Phase one: Introducing solid electrolytes while retaining minimal electrolytes, with positive and negative electrodes as ternary + graphite/silicon electrodes, adopting techniques like negative electrode pre-lithiation to enhance energy density.

Phase two: Gradually replacing all electrolytes with solid electrolytes, using lithium metal instead of graphite/silicon for negative electrodes, while positive electrodes remain ternary materials.

Phase three: Thinning solid electrolyte thickness gradually, and using sulfide/nickel manganese oxide/rich lithium manganese-based materials for positive electrodes.

- Industry Status

Semi-solid batteries combine safety, energy density, and cost-effectiveness, leading to mass production. Semi-solid-state batteries reduce liquid electrolyte content and increase solid electrolyte coatings, combining safety, energy density, and cost-effectiveness, leading to mass production. Full solid-state battery processes are immature, mainly in the R&D phase, while semi-solid batteries have entered mass production. Semi-solid batteries retain minimal liquid electrolytes, alleviating ion conductivity issues, using solidification processes to convert liquid electrolytes to polymer solid electrolytes, coating positive/negative/separators with oxide solid electrolytes, enhancing battery safety/energy density, and compatible with traditional lithium battery processes, achieving lower-cost mass production. Semi-solid batteries are expected to be 10-20% more expensive than liquid lithium batteries. Full solid-state batteries are forecasted to enter concentrated mass production by 2025 and see significant commercialization by 2028. Companies globally have different R&D and production strategies, focusing on full solid-state routes with various material selections and rapid technological iterations, with some already delivering A samples and planning mass production by 2025.

United States: Dominated by startups, and fast commercialization processes. They are emphasizing domestication of the EV industry chain, with numerous solid-state battery startups, focusing on innovation for rapid fundraising and IPOs. Technologies mainly revolve around polymer electrolytes and oxide electrolytes, with fast commercialization processes. Key players include Solid Power, SES, Quantum Scape, etc. Japan: Collaborative industry-academia-government efforts, building sulfide technology systems. Japanese companies have early solid-state battery layouts, often through joint ventures, focusing on sulfide solid electrolytes. Key players include Toyota, Panasonic, Nissan, etc. South Korea: Internal R&D and external collaborations, emphasizing sulfide technology. Research involves internal R&D and external collaborations, focusing on sulfide systems. While slightly slower in battery development compared to Japan, Korean companies excel in electrode material research, likely to build solid-state battery material supply chains quickly. Key players include Samsung SDI, LG, SK Innovation, etc.

Automakers are partnering with battery manufacturers, focusing on next-gen battery tech.

Automakers partner with battery manufacturers, anticipating next-gen battery tech, with foreign automakers leading. Foreign automakers are keen on next-gen battery tech, partnering with battery companies for research. Japanese automakers have early solid-state battery investments, driven by policies, engaging in joint R&D efforts. European and American automakers invest in startups for solid-state battery tech. Chinese automakers also actively collaborate with solid-state battery startups, such as NIO with Eve Energy, BAIC, SAIC, and GAC investing in Qingdao Energy, etc. Automakers’ involvement secures funding, technology, and customer bases for solid-state battery companies, accelerating commercialization.

Solid-State Battery Production Process

- Semi-Solid-State Batteries

The semi-solid-state battery production process is compatible with traditional lithium battery production. Semi-solid batteries can mostly use existing processes, equipment, and materials, facilitating rapid deployment. Their quick market entry is due to leveraging existing liquid battery equipment and processes, with only 10%-20% of process equipment needing changes, primarily involving solid electrolyte membrane introduction, in-situ solidification processes, integrated negative electrode processes, etc.

- Full Solid-State Batteries

Full solid-state lithium-ion batteries differ from traditional lithium-ion battery production processes. Mainstream battery manufacturing processes include stacking and winding methods, partially compatible with full solid-state batteries, but requiring some adjustments.

- Preparation of positive and negative electrode materials can be compatible with traditional liquid lithium-ion battery processes, maintaining existing electrode manufacturing processes;

- Solid electrolyte solution uses sol-gel mixtures, requiring baking to evaporate solvents to obtain solid electrolyte films, necessitating solid electrolyte coating, UV irradiation, and baking processes;

- No electrolyte injection step is needed due to the absence of liquid electrolytes;

- If using sulfide solid electrolyte routes, due to sulfide electrolytes’ sensitivity to polar organic solvents and their reactivity with lithium metal, and lithium’s reactivity with solvents, traditional PVDF-NMP binder systems’ bonding strength is limited. Dry electrode manufacturing processes, utilizing PTFE fiber-based networks, suppress particle volume expansion, and prevent detachment from current collectors, anticipated major usage in dry electrode processes.